Property Investment

Should I turn my investment property into an Airbnb?

I looked at one of my investment properties and what would happen if I turned it into an Airbnb. This includes the actual before and after numbers.

Property Investment

6 min read

As a property investor, you might ask: “Should I furnish my investment property before renting it?”

And if you pay to furnish your property, will you get a good return?

These are the questions my team get asked all the time at Opes Property Management.

In this article, you'll learn the costs of furnishing, the insurance you’ll need, and whether you’ll get a good return.

That way, you can decide whether furnishing your rental property is the right move for you.

In Christchurch, you can usually get an extra 50-$70 in rent per week by furnishing your property.

Barfoot and Thompson data suggests that Auckland properties tend to rent for $60 - $100 more when furnished. That’s specifically for a Central City apartment. Though this data is a little old.

But, the extra rent you get changes based on the property type.

For example, my team at Opes Property Management recently rented studio units in Christchurch. These are 1 bedroom units, where the bedroom and lounge are combined.

These rented for:

So, the investors got an extra $20 - $30 a week by furnishing their property. That’s on the lower end of the range I just mentioned above.

But, properties that need more furniture can charge more extra rent.

For instance, 3-bedroom houses in Christchurch can sometimes get up to $80 – $100 extra per week when fully furnished.

I was recently looking at two 3-bedroom townhouses that were side-by-side. They were practically identical.

The unfurnished one was rented for $640 a week.

The furnished one went for $720 a week.

So, the owner got an extra $80 a week. In this case, the furnished property used to be an Airbnb. So it was furnished right down to the cutlery.

More from Opes:

Let’s dive into the pros and cons of furnishing (or not furnishing) your property.

The benefit of furnishing your property is that you can charge more rent.

Depending on how much it costs to furnish your property, it can deliver a higher return. More on this below.

If your property is small, it can also help the property rent faster. For example, small apartments tend to rent more quickly if they are furnished.

On the cons side, furnishing your property costs money. It might cost $10,000 - $20,000 to buy all the furniture. You’ve got to pay this upfront. Then the return is drip-fed through.

You are also responsible for maintaining the furniture and covering wear and tear. Most furnishings will need replacing every 5-7 years.

Because of the added risk, it’s best to get house and contents insurance. This costs money too.

On top of that, families generally prefer unfurnished spaces. They often want to use their own furniture to make the house feel like home.

Larger furnished homes, while they can achieve extra rent, tend to have a narrower tenant pool. This means they may sit vacant longer.

You’re also more likely to attract a tenant who doesn’t plan to stick around as long. That can mean you need to find tenants more regularly. That costs money.

Furnishing an investment property comes with upfront costs.

For a typical bedroom, you’d need to provide a bed, side tables, and lamps. In the living room, a couch, dining table with chairs, TV, and cabinet are expected.

Essential appliances include a fridge, microwave, washing machine, and dryer.

Fully furnishing a property can easily cost over $7,500, depending on the quality of the furniture you buy.

Budget-friendly retailers like Kmart or The Warehouse can lower costs. You don't have to shop entirely at Farmers or Freedom Furniture.

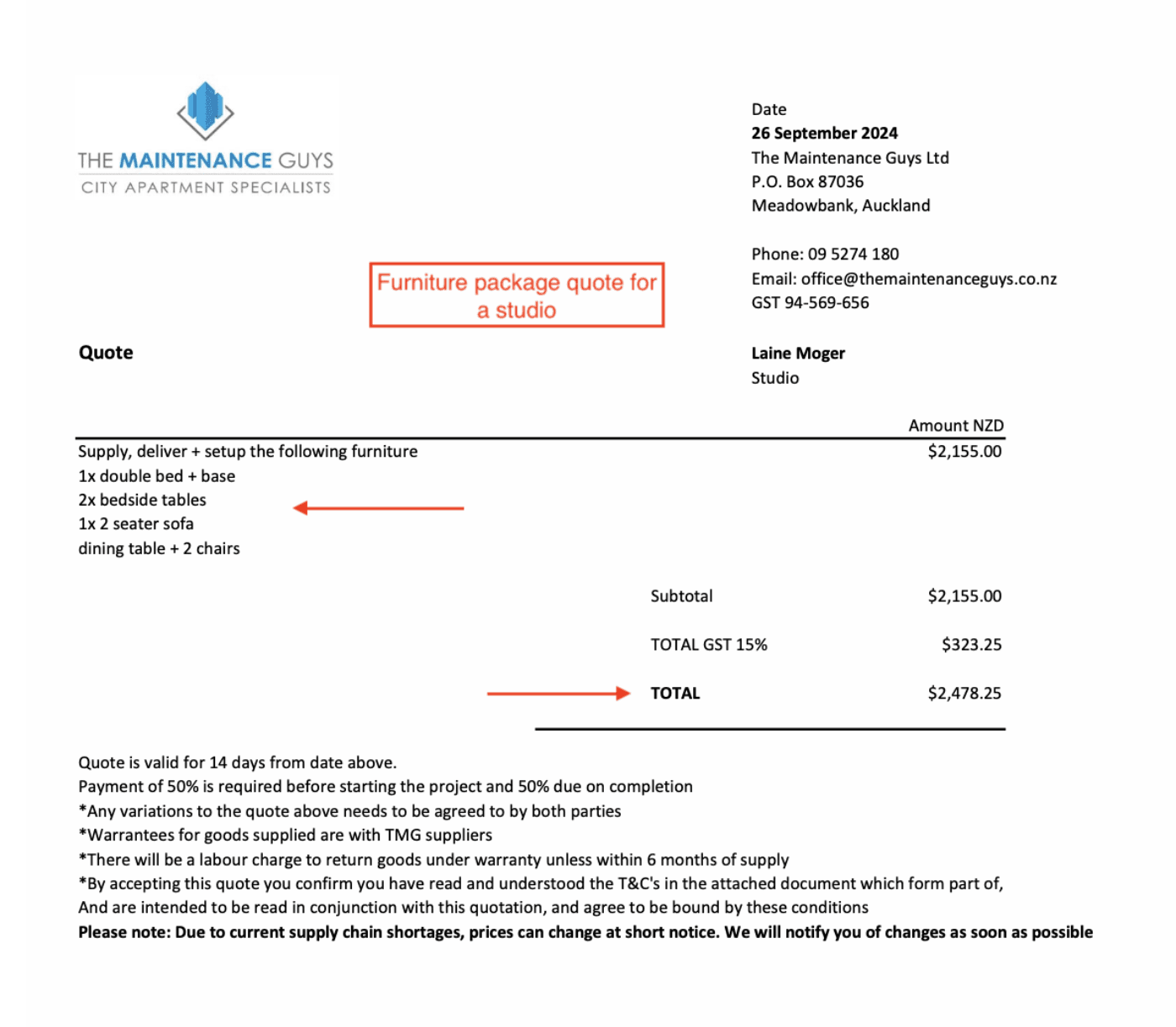

Companies like The Maintenance Guys offer furniture packages for a very reasonable price.

They charge (excluding whiteware):

A fridge and a washing machine might cost just under $1,000.

To see if furnishing your property is worth it, you'll need to consider the potential payback period.

Let’s say you spend $10k on furnishings. And you get an extra $80 per week.

It will take about 2.5 years for you to recoup your costs.

Over 7 years, you might earn $28,000 in extra rent. This makes it a (potentially) worthwhile investment.

You spend $10k and get $28k back over 7 years.

But you’ll also need to consider wear and tear and tax. Furnishings need replacing roughly every 5–7 years. As the investor, you’ll need to handle repairs or replacements if furnishings break down.

Studios and 1-bedroom units are often better off furnished.

They cater to shorter-term tenancies where tenants prefer not to move heavy furniture. That’s especially the case if you own an apartment on the third floor and there isn’t an elevator.

It takes a lot of time and effort to lug a fridge up a couple of flights of stairs.

These sorts of properties tend to attract working professionals as their tenants.

Larger properties, like 3- or 4-bedroom homes, are usually best left unfurnished. These tenants are usually families, and they often have their own furniture.

There are always exceptions. But, the majority of renters looking for bigger homes prefer an empty home.

Sometimes, we do see a demand for larger furnished homes. This happens when you have people coming to the country for work.

The last time we saw a boom of this was during the America’s Cup, but right now, we aren’t seeing this trend.

If, after reading this article, you’re unsure whether to furnish your property or not, research the local market. Use TradeMe to gauge the supply of furnished rentals in your area.

That will give you a sense of whether tenants will expect your property to be furnished.

You might like to talk to a local property manager. You can ask them:

“Is there any demand for fully-furnished properties in my area, and how much extra rent could I get?”

Finally, remember you’ll need contents insurance for any furnishings. Anything that isn’t a standard chattel requires separate cover.

Business Development Manager with 5 years Property Management industry experience. Property Investor in Christchurch

Tom Greene is the Business Development Manager at Opes Property Management in Christchurch with over five years of industry experience and is also an experienced property investor. Tom provides tenancy guidance and insight to those both starting and continuing their investment journey.